- Whakatane 07 308 5015

Rural News

Check back here for updates on our business, our industry and our business community. We also share these updates with our client via our quarterly eNews and Live to our Facebook and LinkedIn pages.

Training Videos

Click here to view our short videos on tips and tricks for using Xero, or contact us to book a one-on-one coaching session with one of our accredited Xero Trainers.

Mortgage Tax Deductions Restored

Understanding the Implications of the Trustee Tax Rate Increase

Fonterra Raises Forecast Amid Supply and Demand Shifts

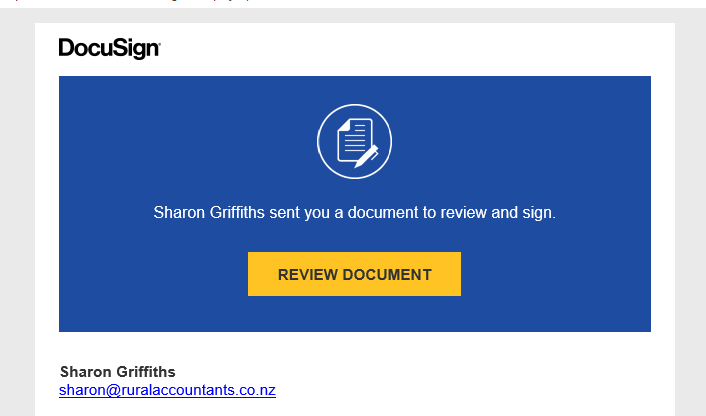

We’re Now eSigning with Annature

Worksafe And ACC - Concerns Over Farm Safety

Debt and Risk Management for Farmers

The Farmlander - Shannon's Interview

Income Equalisation for Flood Relief

Emissions Requirements Continue to Evolve

Nil Filings and GST Registration

Advances in AI A Hopeful Glimpse of the Future

Finding and Keeping Good Staff

Changes to Trust Reporting Requirements

Uncertain Future for Carbon Capturing

Being in Control of Your Household Spending

Rural Accountants Know Horticulture

Fonterra Expands Seaweed Trials for Methane Reduction

Emissions Reduction Plan Funds Big Changes for Agriculture

Government Consultation on Managing Exotic Afforestation

Public Holiday Pay: Know Your Rights and Obligations

Financial Support Packages for Covid Affected Businesses

Inflation - Double-Edged Sword for Farmers

Christmas Holidays & Leave - Tips for Employers

Fortnightly Resurgence Payments

Purchase Price Allocation - A Quick Update

A Quick Update on Accounting Updates

Shannon's Nuffield Scholarship Report - Innovation in the Primary Sector

Business Expenses - What You Can't Claim

Sharemilking – Some Essential Accounting Tips

Dairy Training: Business by the Numbers

Minimum Sick Leave Entitlement Proposed to Increase from 2021

Christmas Holidays & Staff Leave

Why Farm Succession Planning is Important

Our Team Agriculture & Horticulture Field Trip

Preparing for Changes to the Trusts Act

Government reveals 10-year plan to boost primary sector by $44b

Coaching Our Clients on Xero Basics

Paying Your Taxes by Cash or EFTPOS at Westpac

A Seamless Transition to Working Remotely

How to run your payroll using the wage subsidy

Hubdoc Addition Takes Xero Document Filing to the Next Level

Washing Hands a Top Priority - Supporting Our Team with Covid-19

New Rules On Ring Fencing Losses

NZ Manuka Honey Super Hot At Harrods!

Shannon Harnett Awarded 2020 Nuffield Scholarship

Cracker Kiwifruit Payout Forecast

Rural Accountants Celebrates 100 Years!

ACC Subsidises Farmers for Crush Protection Devices (CPD)

These Are 'Interest-ing' Time We Are In

Why We Like smartAR Fee Funding

Anti-Money Laundering & Countering The Financing Of Terrorism; Why It Matters

New Minimum Wage Comes Into Effect

Historic Local Firm Passes the Mantel

Studies Continue for Shannon and Other Nuffield Scholars

DocuSign – Our Trusted Agreements System

ACC Announces Changes to Support Business Owners